Modelo para Acciones (RNN)

Storyboard

El modelo de acciones toma segmentos históricos y el valor que los sigue y busca reconocer el patrón para luego de cualquier secuencia inferir como continuará.

Código y datos

ID:(1792, 0)

Importar librerias

Descripción

Importar las librerías necesarias:

# importing the libraries

import numpy as np

import matplotlib.pyplot as plt

import pandas as pd

import warnings

warnings.filterwarnings('ignore')

ID:(13872, 0)

Cargar los datos

Descripción

Cargar precios de acciones históricos de google:

# load stock prices

dataset_train = pd.read_csv('stock_price_train.csv')

print(dataset_train)Date Open High Low Close Volume

0 1/3/2012 325.25 332.83 324.97 663.59 7,380,500

1 1/4/2012 331.27 333.87 329.08 666.45 5,749,400

2 1/5/2012 329.83 330.75 326.89 657.21 6,590,300

3 1/6/2012 328.34 328.77 323.68 648.24 5,405,900

4 1/9/2012 322.04 322.29 309.46 620.76 11,688,800

... ... ... ... ... ... ...

1253 12/23/2016 790.90 792.74 787.28 789.91 623,400

1254 12/27/2016 790.68 797.86 787.66 791.55 789,100

1255 12/28/2016 793.70 794.23 783.20 785.05 1,153,800

1256 12/29/2016 783.33 785.93 778.92 782.79 744,300

1257 12/30/2016 782.75 782.78 770.41 771.82 1,770,000

[1258 rows x 6 columns]

ID:(13873, 0)

Extraer precios de apertura

Descripción

Formar arreglo con los datos de los precios de apertura de la acción:

# extract opening prices train = dataset_train.loc[:, ['Open']].values train

array([[325.25],

[331.27],

[329.83],

...,

[793.7 ],

[783.33],

[782.75]])

ID:(13874, 0)

Re-escalar valores

Descripción

Para mejorar la calidad del aprendizaje se procede a re-escalar los valores entre 0 y 1:

# feature scaling from sklearn.preprocessing import MinMaxScaler scaler = MinMaxScaler(feature_range = (0, 1)) train_scaled = scaler.fit_transform(train) train_scaled

array([[0.08581368],

[0.09701243],

[0.09433366],

...,

[0.95725128],

[0.93796041],

[0.93688146]])

ID:(13875, 0)

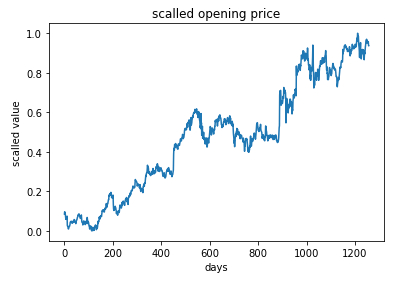

Mostrar valores

Descripción

Los valores se pueden representar en el tiempo:

# show data

plt.plot(train_scaled)

plt.title('scalled opening price')

plt.xlabel('days')

plt.ylabel('scalled value')

plt.show()

ID:(13876, 0)

Crear segmentos

Descripción

Para modelar se extraen 1208 secuencias de 50 valores X_train y el valor que le sigue y_train:

# creating a data structure with 50 timesteps and 1 output

X_train = []

y_train = []

timesteps = 50

for i in range(timesteps, 1258):

X_train.append(train_scaled[i-timesteps:i, 0])

y_train.append(train_scaled[i, 0])

X_train, y_train = np.array(X_train), np.array(y_train)

ID:(13877, 0)

Re-ordenar valores

Descripción

Reordenar los valores de entrenamiento train con la función np.reshape:

# reshaping

X_train = np.reshape(X_train, (X_train.shape[0], X_train.shape[1], 1))

print(X_train.shape[0],',',X_train.shape[1],',',y_train.shape[0])

print('X_train=',X_train)

print('y_train=',y_train)1208 , 50 , 1208

X_train= [[[0.08581368]

[0.09701243]

[0.09433366]

...

[0.03675869]

[0.04486941]

[0.05065481]]

...

[[0.96569685]

[0.97510976]

[0.95966962]

...

[0.95163331]

[0.95725128]

[0.93796041]]]

y_train= [0.05214302 ... 0.93688146]

ID:(13878, 0)

Definir, formar y entrenar modelo

Descripción

El modelo se define como un modelo secuencial Sequential(), se agregan cuatro capas SimpleRNN con la función add y una capa final de un solo elemento. El modelo se procede a estructurar con el comando compile para luego entrenarlo con el comando fit:

# importing the Keras libraries and packages from keras.models import Sequential from keras.layers import Dense from keras.layers import SimpleRNN from keras.layers import Dropout # initialising the RNN stock_regressor = Sequential() # adding the first RNN layer and some Dropout regularisation stock_regressor.add(SimpleRNN(units = 50,activation='tanh', return_sequences = True, input_shape = (X_train.shape[1], 1))) stock_regressor.add(Dropout(0.2)) # adding a second RNN layer and some Dropout regularisation stock_regressor.add(SimpleRNN(units = 50,activation='tanh', return_sequences = True)) stock_regressor.add(Dropout(0.2)) # adding a third RNN layer and some Dropout regularisation stock_regressor.add(SimpleRNN(units = 50,activation='tanh', return_sequences = True)) stock_regressor.add(Dropout(0.2)) # adding a fourth RNN layer and some Dropout regularisation stock_regressor.add(SimpleRNN(units = 50)) stock_regressor.add(Dropout(0.2)) # adding the output layer stock_regressor.add(Dense(units = 1)) # compiling the RNN stock_regressor.compile(optimizer = 'adam', loss = 'mean_squared_error') # fitting the RNN to the Training set stock_regressor.fit(X_train, y_train, epochs = 100, batch_size = 32)

Epoch 1/100

38/38 [==============================] - 17s 20ms/step - loss: 0.4512

Epoch 2/100

38/38 [==============================] - 1s 19ms/step - loss: 0.2486

Epoch 3/100

38/38 [==============================] - 1s 18ms/step - loss: 0.1825

...

Epoch 98/100

38/38 [==============================] - 1s 19ms/step - loss: 0.0021

Epoch 99/100

38/38 [==============================] - 1s 19ms/step - loss: 0.0022

Epoch 100/100

38/38 [==============================] - 1s 18ms/step - loss: 0.0022

ID:(13879, 0)

Cargar los datos para evaluar

Descripción

Cargar precios de acciones de google para el 2017 de modo de compararlos con los precios pronosticados:

# load real stock prices (2017)

dataset_test = pd.read_csv('stock_price_test.csv')

print(dataset_test)Date Open High Low Close Volume

0 1/3/2017 778.81 789.63 775.80 786.14 1,657,300

1 1/4/2017 788.36 791.34 783.16 786.90 1,073,000

2 1/5/2017 786.08 794.48 785.02 794.02 1,335,200

3 1/6/2017 795.26 807.90 792.20 806.15 1,640,200

4 1/9/2017 806.40 809.97 802.83 806.65 1,272,400

5 1/10/2017 807.86 809.13 803.51 804.79 1,176,800

6 1/11/2017 805.00 808.15 801.37 807.91 1,065,900

7 1/12/2017 807.14 807.39 799.17 806.36 1,353,100

8 1/13/2017 807.48 811.22 806.69 807.88 1,099,200

9 1/17/2017 807.08 807.14 800.37 804.61 1,362,100

10 1/18/2017 805.81 806.21 800.99 806.07 1,294,400

11 1/19/2017 805.12 809.48 801.80 802.17 919,300

12 1/20/2017 806.91 806.91 801.69 805.02 1,670,000

13 1/23/2017 807.25 820.87 803.74 819.31 1,963,600

14 1/24/2017 822.30 825.90 817.82 823.87 1,474,000

15 1/25/2017 829.62 835.77 825.06 835.67 1,494,500

16 1/26/2017 837.81 838.00 827.01 832.15 2,973,900

17 1/27/2017 834.71 841.95 820.44 823.31 2,965,800

18 1/30/2017 814.66 815.84 799.80 802.32 3,246,600

19 1/31/2017 796.86 801.25 790.52 796.79 2,160,600

ID:(13880, 0)

Extraer precios de apertura para evaluar

Descripción

Formar arreglo con los datos de los precios de apertura de la acción para la evaluación:

# extract opening prices para evaluar real_stock_price = dataset_test.loc[:, ['Open']].values real_stock_price

array([[778.81],

[788.36],

[786.08],

[795.26],

[806.4 ],

[807.86],

[805. ],

[807.14],

[807.48],

[807.08],

[805.81],

[805.12],

[806.91],

[807.25],

[822.3 ],

[829.62],

[837.81],

[834.71],

[814.66],

[796.86]])

ID:(13881, 0)

Re-escalar valores para la evaluación

Descripción

Para poder comparar se procede a escalar los valores de evaluación en el rango 0 y 1:

# getting the predicted stock price of 2017 dataset_total = pd.concat((dataset_train['Open'], dataset_test['Open']), axis = 0) inputs = dataset_total[len(dataset_total) - len(dataset_test) - timesteps:].values.reshape(-1,1) inputs = scaler.transform(inputs) # min max scaler inputs

array([[0.97510976],

[0.95966962],

[0.97808617],

...

[1.03354044],

[0.99624228],

[0.9631297 ]])

ID:(13882, 0)

Pronosticar precios

Descripción

Se forma de los valores input los valores de testeo X_text y con la función predict se procede a pronosticar los valores:

X_test = []

for i in range(timesteps, 70):

X_test.append(inputs[i-timesteps:i, 0])

X_test = np.array(X_test)

X_test = np.reshape(X_test, (X_test.shape[0], X_test.shape[1], 1))

predicted_stock_price = stock_regressor.predict(X_test)

predicted_stock_price = scaler.inverse_transform(predicted_stock_price)

print(predicted_stock_price)[[791.3195 ]

[788.87964]

[789.0553 ]

[791.17883]

[793.6802 ]

[796.1757 ]

[798.198 ]

[799.31714]

[799.56616]

[799.31494]

[799.6199 ]

[799.514 ]

[798.5145 ]

[798.20874]

[798.54846]

[800.562 ]

[803.8723 ]

[807.5642 ]

[809.4684 ]

[807.31573]]

ID:(13883, 0)

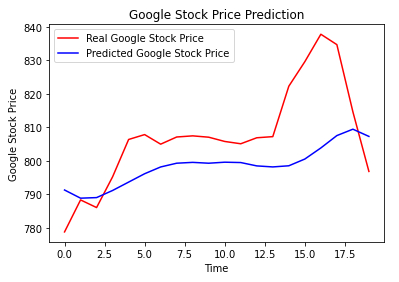

Comparar valores pronosticados con reales

Descripción

Finalmente se muestran los valores pronosticados y los reales:

# Visualising the results

plt.plot(real_stock_price, color = 'red', label = 'Real Google Stock Price')

plt.plot(predicted_stock_price, color = 'blue', label = 'Predicted Google Stock Price')

plt.title('Google Stock Price Prediction')

plt.xlabel('Time')

plt.ylabel('Google Stock Price')

plt.legend()

plt.show()\

ID:(13884, 0)