Model for Stock (RNN)

Storyboard

The stock model takes historical segments and the value that follows them and seeks to recognize the pattern and after any sequence infer how it will continue.

Code and data

ID:(1792, 0)

Import libraries

Description

Import the necessary libraries:

# importing the libraries

import numpy as np

import matplotlib.pyplot as plt

import pandas as pd

import warnings

warnings.filterwarnings('ignore')

ID:(13872, 0)

Load data

Description

Load historical stock prices from google:

# load stock prices

dataset_train = pd.read_csv('stock_price_train.csv')

print(dataset_train)Date Open High Low Close Volume

0 1/3/2012 325.25 332.83 324.97 663.59 7,380,500

1 1/4/2012 331.27 333.87 329.08 666.45 5,749,400

2 1/5/2012 329.83 330.75 326.89 657.21 6,590,300

3 1/6/2012 328.34 328.77 323.68 648.24 5,405,900

4 1/9/2012 322.04 322.29 309.46 620.76 11,688,800

... ... ... ... ... ... ...

1253 12/23/2016 790.90 792.74 787.28 789.91 623,400

1254 12/27/2016 790.68 797.86 787.66 791.55 789,100

1255 12/28/2016 793.70 794.23 783.20 785.05 1,153,800

1256 12/29/2016 783.33 785.93 778.92 782.79 744,300

1257 12/30/2016 782.75 782.78 770.41 771.82 1,770,000

[1258 rows x 6 columns]

ID:(13873, 0)

Extract opening prices

Description

Form an arrangement with the data of the opening prices of the share:

# extract opening prices train = dataset_train.loc[:, ['Open']].values train

array([[325.25],

[331.27],

[329.83],

...,

[793.7 ],

[783.33],

[782.75]])

ID:(13874, 0)

Rescale values

Description

To improve the quality of learning, the values between 0 and 1 are re-scaled:

# feature scaling from sklearn.preprocessing import MinMaxScaler scaler = MinMaxScaler(feature_range = (0, 1)) train_scaled = scaler.fit_transform(train) train_scaled

array([[0.08581368],

[0.09701243],

[0.09433366],

...,

[0.95725128],

[0.93796041],

[0.93688146]])

ID:(13875, 0)

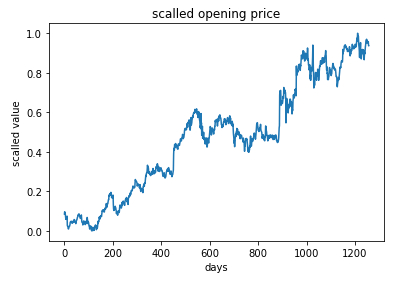

Show values

Description

The values can be represented in time:

# show data

plt.plot(train_scaled)

plt.title('scalled opening price')

plt.xlabel('days')

plt.ylabel('scalled value')

plt.show()

ID:(13876, 0)

Create Segments

Description

For modeling, 1208 sequences of 50 X_train values and the following y_train value are extracted:

# creating a data structure with 50 timesteps and 1 output

X_train = []

y_train = []

timesteps = 50

for i in range(timesteps, 1258):

X_train.append(train_scaled[i-timesteps:i, 0])

y_train.append(train_scaled[i, 0])

X_train, y_train = np.array(X_train), np.array(y_train)

ID:(13877, 0)

Re-order values

Description

Reorder the training values train with the np.reshape function:

# reshaping

X_train = np.reshape(X_train, (X_train.shape[0], X_train.shape[1], 1))

print(X_train.shape[0],',',X_train.shape[1],',',y_train.shape[0])

print('X_train=',X_train)

print('y_train=',y_train)1208 , 50 , 1208

X_train= [[[0.08581368]

[0.09701243]

[0.09433366]

...

[0.03675869]

[0.04486941]

[0.05065481]]

...

[[0.96569685]

[0.97510976]

[0.95966962]

...

[0.95163331]

[0.95725128]

[0.93796041]]]

y_train= [0.05214302 ... 0.93688146]

ID:(13878, 0)

Define, train and train model

Description

The model is defined as a Sequential () sequential model, four SimpleRNN layers are added with the add function and a final single element layer . The model is structured with the compile command and then training it with the fit command:

# importing the Keras libraries and packages from keras.models import Sequential from keras.layers import Dense from keras.layers import SimpleRNN from keras.layers import Dropout # initialising the RNN regressor = Sequential() # adding the first RNN layer and some Dropout regularisation regressor.add(SimpleRNN(units = 50,activation='tanh', return_sequences = True, input_shape = (X_train.shape[1], 1))) regressor.add(Dropout(0.2)) # adding a second RNN layer and some Dropout regularisation regressor.add(SimpleRNN(units = 50,activation='tanh', return_sequences = True)) regressor.add(Dropout(0.2)) # adding a third RNN layer and some Dropout regularisation regressor.add(SimpleRNN(units = 50,activation='tanh', return_sequences = True)) regressor.add(Dropout(0.2)) # adding a fourth RNN layer and some Dropout regularisation regressor.add(SimpleRNN(units = 50)) regressor.add(Dropout(0.2)) # adding the output layer regressor.add(Dense(units = 1)) # compiling the RNN regressor.compile(optimizer = 'adam', loss = 'mean_squared_error') # fitting the RNN to the Training set regressor.fit(X_train, y_train, epochs = 100, batch_size = 32)

Epoch 1/100

38/38 [==============================] - 17s 20ms/step - loss: 0.4512

Epoch 2/100

38/38 [==============================] - 1s 19ms/step - loss: 0.2486

Epoch 3/100

38/38 [==============================] - 1s 18ms/step - loss: 0.1825

...

Epoch 98/100

38/38 [==============================] - 1s 19ms/step - loss: 0.0021

Epoch 99/100

38/38 [==============================] - 1s 19ms/step - loss: 0.0022

Epoch 100/100

38/38 [==============================] - 1s 18ms/step - loss: 0.0022

ID:(13879, 0)

Load data to evaluate

Description

Load google stock prices for 2017 to compare to forecasted prices:

# load real stock prices (2017)

dataset_test = pd.read_csv('stock_price_test.csv')

print(dataset_test)Date Open High Low Close Volume

0 1/3/2017 778.81 789.63 775.80 786.14 1,657,300

1 1/4/2017 788.36 791.34 783.16 786.90 1,073,000

2 1/5/2017 786.08 794.48 785.02 794.02 1,335,200

3 1/6/2017 795.26 807.90 792.20 806.15 1,640,200

4 1/9/2017 806.40 809.97 802.83 806.65 1,272,400

5 1/10/2017 807.86 809.13 803.51 804.79 1,176,800

6 1/11/2017 805.00 808.15 801.37 807.91 1,065,900

7 1/12/2017 807.14 807.39 799.17 806.36 1,353,100

8 1/13/2017 807.48 811.22 806.69 807.88 1,099,200

9 1/17/2017 807.08 807.14 800.37 804.61 1,362,100

10 1/18/2017 805.81 806.21 800.99 806.07 1,294,400

11 1/19/2017 805.12 809.48 801.80 802.17 919,300

12 1/20/2017 806.91 806.91 801.69 805.02 1,670,000

13 1/23/2017 807.25 820.87 803.74 819.31 1,963,600

14 1/24/2017 822.30 825.90 817.82 823.87 1,474,000

15 1/25/2017 829.62 835.77 825.06 835.67 1,494,500

16 1/26/2017 837.81 838.00 827.01 832.15 2,973,900

17 1/27/2017 834.71 841.95 820.44 823.31 2,965,800

18 1/30/2017 814.66 815.84 799.80 802.32 3,246,600

19 1/31/2017 796.86 801.25 790.52 796.79 2,160,600

ID:(13880, 0)

Extract opening prices to evaluate

Description

Form an arrangement with the data of the opening prices of the stock for the evaluation:

# extract opening prices para evaluar real_stock_price = dataset_test.loc[:, ['Open']].values real_stock_price

array([[778.81],

[788.36],

[786.08],

[795.26],

[806.4 ],

[807.86],

[805. ],

[807.14],

[807.48],

[807.08],

[805.81],

[805.12],

[806.91],

[807.25],

[822.3 ],

[829.62],

[837.81],

[834.71],

[814.66],

[796.86]])

ID:(13881, 0)

Rescale values for evaluation

Description

In order to compare, the evaluation values are scaled in the range 0 and 1:

# getting the predicted stock price of 2017 dataset_total = pd.concat((dataset_train['Open'], dataset_test['Open']), axis = 0) inputs = dataset_total[len(dataset_total) - len(dataset_test) - timesteps:].values.reshape(-1,1) inputs = scaler.transform(inputs) # min max scaler inputs

array([[0.97510976],

[0.95966962],

[0.97808617],

...

[1.03354044],

[0.99624228],

[0.9631297 ]])

ID:(13882, 0)

Forecast prices

Description

The input values are formed into the X_text test values and with the predict function the values are predicted:

X_test = []

for i in range(timesteps, 70):

X_test.append(inputs[i-timesteps:i, 0])

X_test = np.array(X_test)

X_test = np.reshape(X_test, (X_test.shape[0], X_test.shape[1], 1))

predicted_stock_price = stock_regressor.predict(X_test)

predicted_stock_price = scaler.inverse_transform(predicted_stock_price)

print(predicted_stock_price)[[791.3195 ]

[788.87964]

[789.0553 ]

[791.17883]

[793.6802 ]

[796.1757 ]

[798.198 ]

[799.31714]

[799.56616]

[799.31494]

[799.6199 ]

[799.514 ]

[798.5145 ]

[798.20874]

[798.54846]

[800.562 ]

[803.8723 ]

[807.5642 ]

[809.4684 ]

[807.31573]]

ID:(13883, 0)

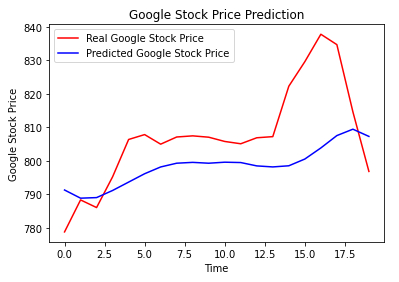

Compare Predicted Values With Actuals

Description

Finally, the predicted and actual values are displayed:

# Visualising the results

plt.plot(real_stock_price, color = 'red', label = 'Real Google Stock Price')

plt.plot(predicted_stock_price, color = 'blue', label = 'Predicted Google Stock Price')

plt.title('Google Stock Price Prediction')

plt.xlabel('Time')

plt.ylabel('Google Stock Price')

plt.legend()

plt.show()\

ID:(13884, 0)